As Canada continues to recover from the health and economic impacts of the COVID-19 pandemic, there are concerns for the financial well-being of Canadians and a heightened awareness of the need for households to maintain or build their financial resilience. Financial resilience is a household’s ability to get through financial hardship, stressors and shocks.

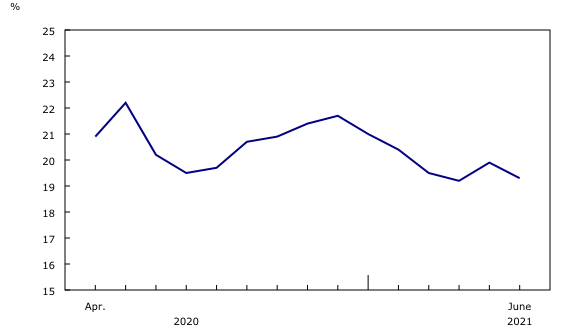

This study brings together key findings from different perspectives to provide insights on the financial well-being and financial resilience of Canadians during the first year of the pandemic. For example, data from Statistics Canada’s Labour Force Survey show that the share of all Canadians living in households who reported difficulty meeting their basic financial needs peaked in May (22.2%) and again in December (21.7%) of 2020, and was sitting at 19.3% as of June 2021.

In Canada, some groups were at higher risk of living in a household that reported facing financial difficulty than others. In June 2021, among Canadians aged 15 to 69, nearly 3 in 10 persons from population groups designated as a visible minority (29.3%) and nearly 3 in 10 Indigenous people (27.0%) lived in a household that reported experiencing financial hardship, compared with fewer than 2 in 10 (15.6%) for Canadians belonging to neither group. South Asian (31.4%), Chinese (22.6%) and Black (35.8%) Canadians, who represent the three largest visible minority groups in Canada, were all more likely to live in a household that reported financial hardship than Canadians who are not designated as either a visible minority or Indigenous.

This study is the product of a partnership between Statistics Canada and Seymour Management Consulting Inc. and includes results based on the Seymour Financial Resilience IndexTM. According to this index, many households have become more financially resilient over the course of the pandemic, as evidenced by the lower share of households deemed financially “extremely vulnerable” by the index in June 2021 (16.5%) compared with just prior to the pandemic in February 2020 (23.3%). The improvement in Canadians’ financial resilience index since the onset of the pandemic is supported by many factors, including changes in households’ consumer and financial behaviours amid lockdowns. Other data from Statistics Canada also revealed an increase in savings and a reduction in non-mortgage debt among households over the pandemic period.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; [email protected]) or Media Relations (613-951-4636; [email protected]).

Recent Comments